tax benefits of retiring in nevada

In the top 10 of states according to data from NOAA. All of that savings adds up.

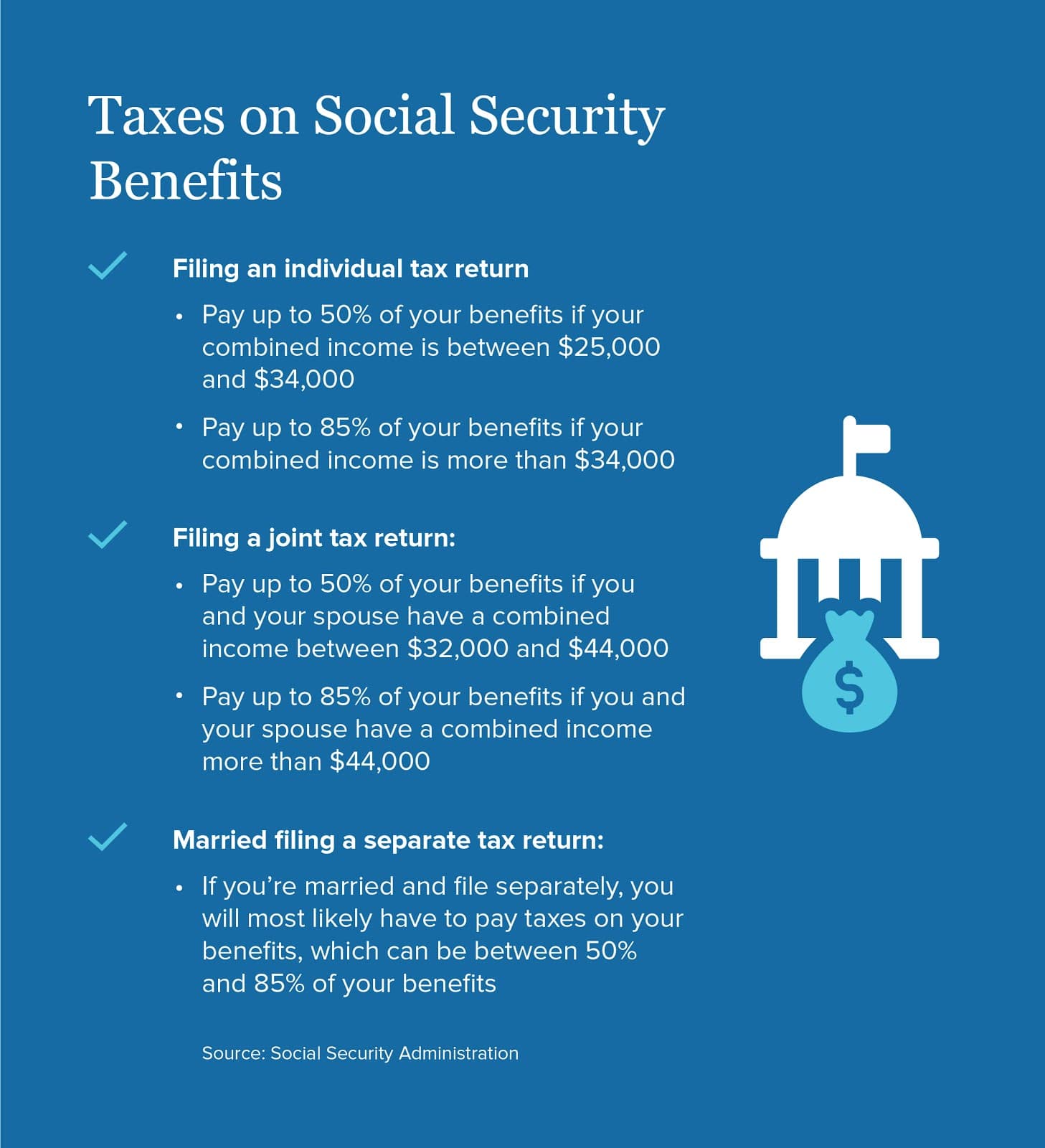

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

Retirees in Nevada are always winners when it comes to state income taxes.

. Nevadans also dont pay sales tax on home sales food medicine and other items. If you live in these 12 states you need to. The Silver State doesnt tax pension incomes and any other income.

Offer helpful instructions and related details about Advantages Of Retiring In Nevada - make it easier for users to find business information than ever. The Silver State doesnt tax pension incomes and any other income because it doesnt have an income tax. Nevada has far more sunny days and lower humidity to enjoy them than most states.

The statistics show that more people are retiring in Las Vegas and that it is beneficial to them. However the amount of property taxes is not exceptionally high by most standards. 76 of seniors who retire in.

Offer helpful instructions and related details about Retiring In Nevada Taxes - make it easier for users to find business information than ever. Ad Bark Does the Legwork to Find Nevada Tax Return Experts. No Franchise Tax.

The congressional bill proposal would halt the. Answer 1 of 2. Our tax dollars are constantly at work and building.

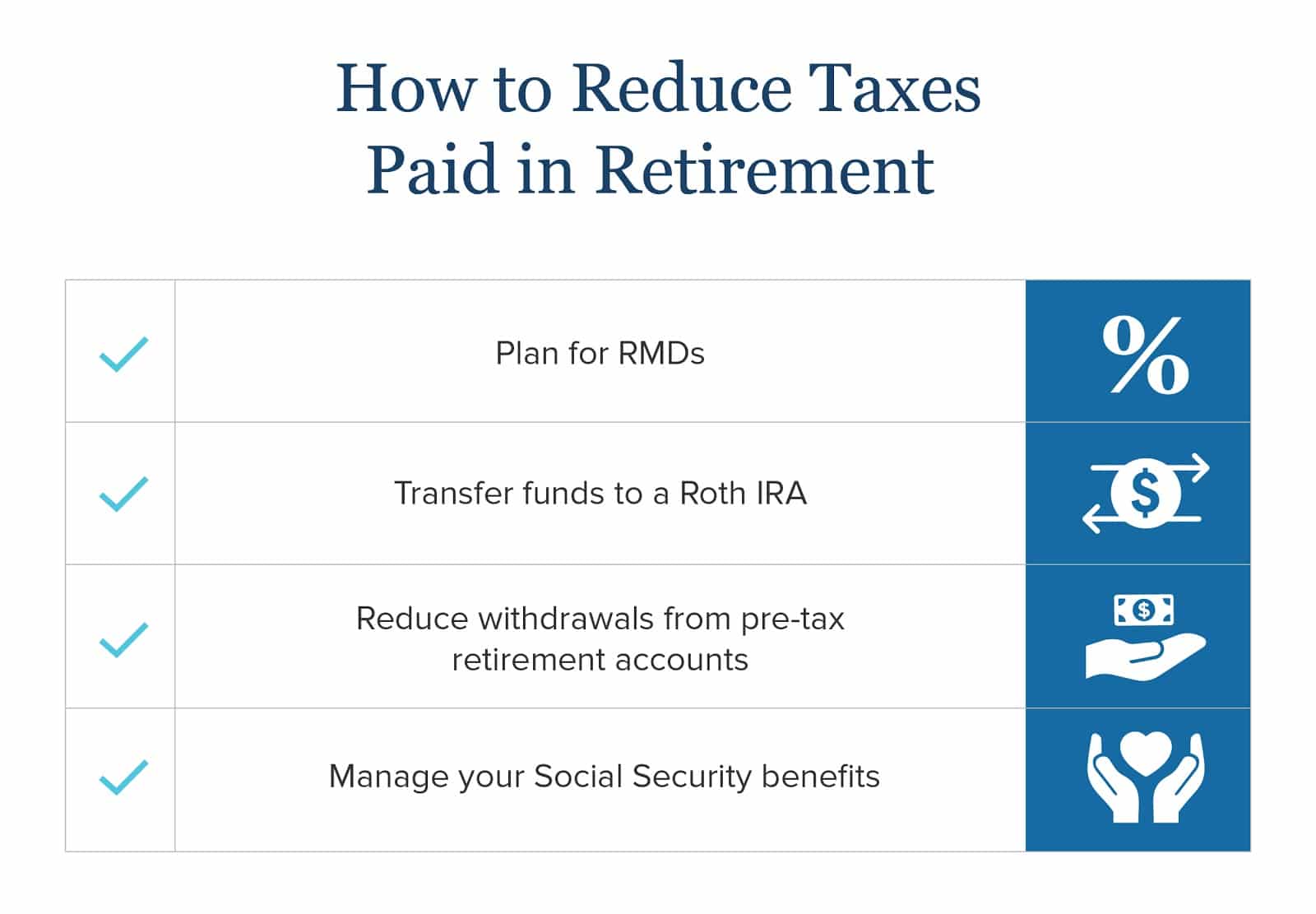

The lack of income tax is a huge benefit but wait. The amount of benefit depends on household income and taxes or rent paid. No Personal Income Tax.

The Silver State wont tax your pension incomeor any of your other income for that. Top Reasons to Incorporate in Nevada. The biggest benefit for retirees seeking a home in Nevada is perhaps the income-tax-friendly policies.

Youll Likely Pay Less in Taxes. Top Ramen Recipes Top Ramen. Nevada has no state income tax our housing taxes are decent we have sunshine most every day of the year.

If you have a 500000 portfolio get this must-read guide by Fisher Investments. 10th highest income for seniors in Las Vegas. Nominal Annual Fees.

No Corporate Income Tax. Counties can assess option taxes as well making the combined state and county sales taxes rate in some areas as high as 81. No State Income Tax.

The property taxes assessed on an. The filing period for the Tax Assistance Rental Rebate program is from February 1 to April 30 of each year. 1 day agoIf your income under this definition isnt above the 25000 or 32000 limits your Social Security benefits are yours to keep tax-free.

Ad Read this guide to learn ways to avoid running out of money in retirement. The state of Nevada does assess taxes on property. No Taxes on Corporate Shares.

The state sales tax in Nevada is 685. Even if you are required to source part of your income from a state that has an income tax you may still benefit from a significant reduction to your overall tax burden.

Nevada Tax Advantages And Benefits Retirebetternow Com

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

Retiring These States Won T Tax Your Distributions

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

States That Don T Tax Retirement Income Personal Capital

Choosing A Retirement Destination Tax Considerations Lvbw

At What Age Is Social Security No Longer Taxed In The Us As Usa

The Most Tax Friendly States For Retirees Vision Retirement

Nevada Retirement Tax Friendliness Smartasset

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

Nevada Retirement Tax Friendliness Smartasset

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)